The Philippines’ leading financial app, GCash, takes another big leap towards reaching its financial inclusion goals as it sees loan disbursements hit P50 billion as of 2022, thanks to the strong performance of its credit affiliate Fuse Lending, Inc.

“We have already reached 2 million borrowers in the past year, providing many individuals with access to their first lending product from a legitimate financial institution. These include micro, small, and medium enterprises (MSMEs) like vendors in public markets as well as tricycle drivers,” said Tony Isidro, Chief Executive Officer of Fuse Lending.Isidro also shared that GCash aims to keep the strong growth momentum of its lending business by introducing more innovations to democratize formal loans. For one, with prepaid load a top commodity among Filipinos, GCash is launching Borrow Load – a feature that would allow customers to borrow prepaid credits for all major networks, introducing them to the concept of borrowing with ease.

“To further grow our lending business, GCash is planning to introduce its lending products in Paleng-QR Ph transactions, wherein our customers can use their personal credit line when transacting in public markets. This year, eligible customers can also avail of 0% installment payments in select merchants through GGives,” Isidro also noted.

In line with its financial inclusion goals, GCash is also preparing to launch special loans for underbanked individuals like farmers and even sari-sari store owners, added Isidro.

“As we see a banner year for our lending business, our 76 million users can expect more financial solutions from GCash as we continue to strive giving underserved individuals access to fair loans that spark better everydays for all Filipinos,” said Martha Sazon, President and CEO of GCash.

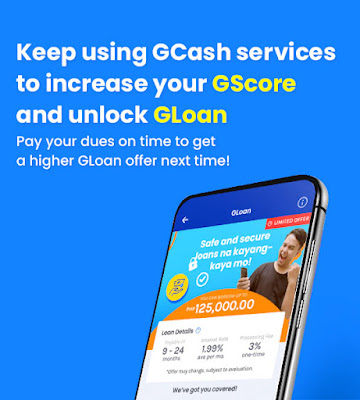

Fuse Lending has been leading the lending initiatives of GCash through three products: GCredit, which is in partnership with regional banking giant CIMB Bank, GGives, and GLoan.

GCredit gives GCash users an accessible credit line that can be used in QR-based, online, and bills payments. GGives is a ‘buy now pay later’ product that enables customers to purchase from their favorite brands and pay later through easy installments. Meanwhile, GLoan offers an affordable and convenient way to borrow money with users getting cash directly in their wallets after a few taps on their phones.

###

About GCash

GCash (G-Xchange, Inc.) is the #1 Finance App in the Philippines. Through the GCash App, 76M registered users can easily purchase prepaid airtime; pay bills at over 1,600 partner billers nationwide; send and receive money anywhere in the Philippines, even to other bank accounts; purchase from over 5.2M partner merchants and social sellers; and get access to savings, credit, loans, insurance and invest money, and so much more, all at the convenience of their smartphones. GCash is a wholly-owned subsidiary of Mynt (Globe Fintech Innovations, Inc.), the first and only duacorn in the Philippines.

GCash was recognized by The Asian Banker (TAB) and by the IDC in 2021 for its outstanding digital financial inclusion programs.

No comments:

Post a Comment